If you want to know how to trade stocks successfully, the first step is to emulate what successful traders do. A great trader doesn’t make decisions based on luck or chance. Instead, they invest in areas they thoroughly understand, making decisions based on a high probability of success. Every trade they make is backed by research and a deep understanding of the stock or market they are investing in. This is why many successful traders avoid investing in areas they don’t have expertise in.

The Importance of Knowledge and Research

One of the biggest mistakes that average investors make is buying stocks without having in-depth knowledge of the company or the industry they are investing in. Many people make the mistake of buying stocks based on hearsay or recommendations from people who may not have much expertise in stock trading. They fail to examine the stock’s historical performance, price trends, or management strategies. As a result, these investors often end up investing in losing stocks that could have been avoided if they had taken the time to properly research and understand what they were getting into.

Recognizing When Not to Invest

Successful traders also know that it is not always a good time to invest in the stock market. In fact, many traders spend a lot of time waiting for the right opportunity to invest, rather than feeling the need to invest constantly. Investing without a proper opportunity usually leads to poor decisions. It’s important to avoid rushing into investments and only act when the right opportunity aligns with your trading strategy.

If you’re new to the stock market or just starting to learn how to trade stocks, it’s crucial not to rush. Don’t jump into the first investment that appears. Instead, take the time to study the market and find investments that meet your criteria.

The Importance of a Systematic Approach

One of the key differences between successful traders and those who struggle is the systematic approach to trading. The best traders follow a well-defined system that they’ve tested over time. These systems are built on proven principles that guide every buy and sell decision. Successful traders don’t deviate from their system, as it has shown to work for them over time.

Emotion plays no part in the decisions of the best traders. They don’t allow fear, greed, or ego to affect their trading. They follow their systems and rules without allowing outside influences or advice from others to steer them away from their strategy.

How the Olymp Trade Demo Can Help

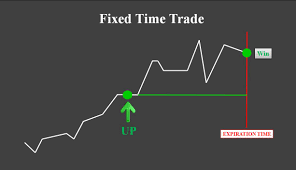

If you’re new to trading and want to learn how to trade stocks or other assets, a great tool to get started is the Olymp Trade demo account. The Olymp Trade demo account allows you to practice trading in a risk-free environment using virtual funds. This provides you with the opportunity to familiarize yourself with market conditions, stock price fluctuations, and trading strategies without the risk of losing real money.

By using the Olymp Trade demo account, you can test various strategies, refine your skills, and gain confidence before making actual trades. It’s an excellent way to understand how to trade stocks and to practice following a disciplined, systematic approach to trading—just like the experts.

In conclusion, if you want to trade stocks successfully, it’s essential to do your research, avoid emotional decision-making, and follow a proven system. Tools like the Olymp Trade demo account can help you practice and gain experience, setting you on the right path toward becoming a successful trader.